Addendum 4

MAGI Medicaid Income Deductions

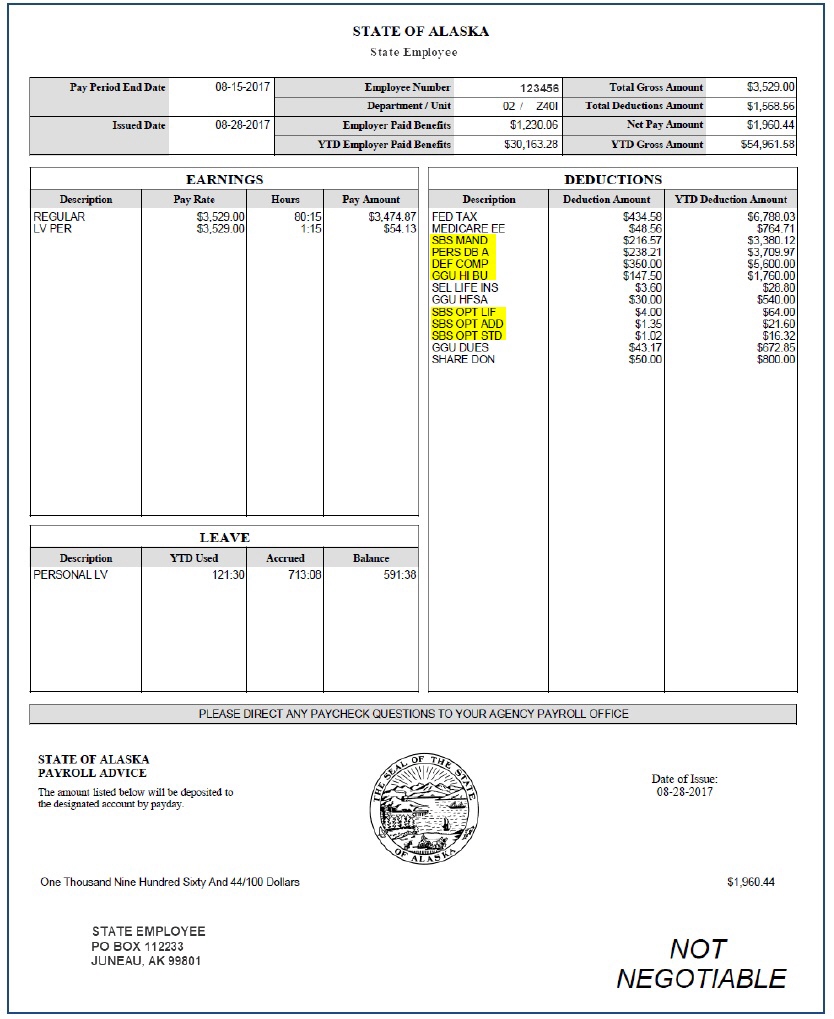

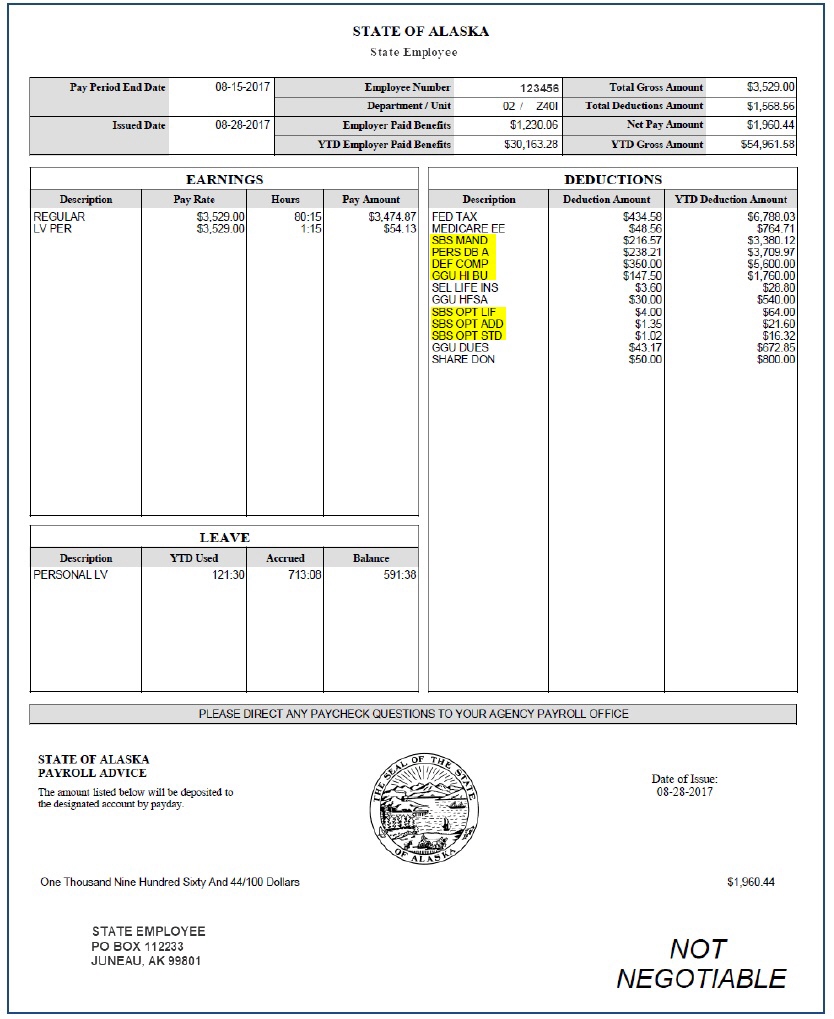

Pre-Tax Payroll Deductions

The types of payroll deductions that will need to be subtracted from gross pay include:

1. Most health insurance premiums paid by the employee;

2. Most Employee contributions to 401(k) and 403(b) retirement plans;

3. For State of Alaska employees, employee contributions to SBS and PERS accounts; and

4. Contributions to deferred compensation plans.

Example:

Using a State of Alaska paystub, note the information found in the "Deductions" section. Review the descriptions thoroughly to identify whether or not they are allowable pre-tax deductions for MAGI Medicaid. Some examples of allowable pre-tax deductions have been highlighted. The amount shown next to "Total Gross Amount" at the top of the paystub should be used as gross income.

Other Allowable Income Tax Deductions

In addition to pre-tax payroll deductions, if an individual claims one of the allowable income deductions below, the deduction is subtracted before countable MAGI income is determined. Many of these deductions are yearly deductions so the actual allowable monthly deduction will be the yearly amount divided by 12. If the amount is not reported or known, make the eligibility determination without applying the deduction.

1. Educator Expenses

Eligible educators can deduct up to $250 of qualified expenses paid in the taxable year. The maximum deduction is $500 for spouses who are both educators and filing jointly.

2. Certain Business Expenses of Reservists, Performing Artists and Fee-Basis Government Officials

These deductions include:

3. Health Savings Account Deduction

A deduction for contributions made from a person’s income to a qualified Health Savings Account during the year.

4. Moving Expenses

Active duty members of the Armed Forces (and their spouses and dependents) who move because of a military order that calls for a permanent change of station can generally deduct unreimbursed transportation and lodging expenses, costs of packing and transporting household goods, and charges related to storing and insuring items while in transit.

5. Deductible Part of Self-Employment Tax

A deduction for the employer-equivalent portion of self-employment tax.

6. Self-Employed SEP, SIMPLE and Qualified Plans

A deduction for contributions to a qualified retirement plan for the self-employed and clergy members.

7. Self-Employed Health Insurance Deductions

A deduction for the amount paid a self-employed person paid for health insurance for him or herself, spouse and dependents.

8. Penalty on Early Withdrawal of Savings

A deduction for penalties paid for early withdrawal of savings from certain financial accounts.

9. Alimony Paid

Starting with judgments finalized or modified after January 1, 2019, neither spouse will include alimony on the tax return. Divorces and separations finalized or modified prior to January 1, 2019 will have alimony included as income, and deductions with those judgments are allowable.

10. IRA Deduction

Contributions made to a traditional IRA during the taxable year may be deducted.

11. Student Loan Interest Deduction

A person may take this deduction if all of the following apply:

12. Domestic Production Activities Deduction

A deduction of up to 9% of qualified production activity income from any of the following:

13. 5% Disregard

Individuals who are over the income limit for MAGI Medicaid, will receive a disregard of 5% of the FPL for their household size. That amount is deducted from their countable income. The resulting amount is then compared to the income limit. ARIES applies this deduction automatically to households who exceed the income limit.

If you are unsure if a deduction is allowable for MAGI Medicaid, please email the policy unit at hss.dpa.policy@alaska.gov

|

|

||

|

|

|