Addendum 5

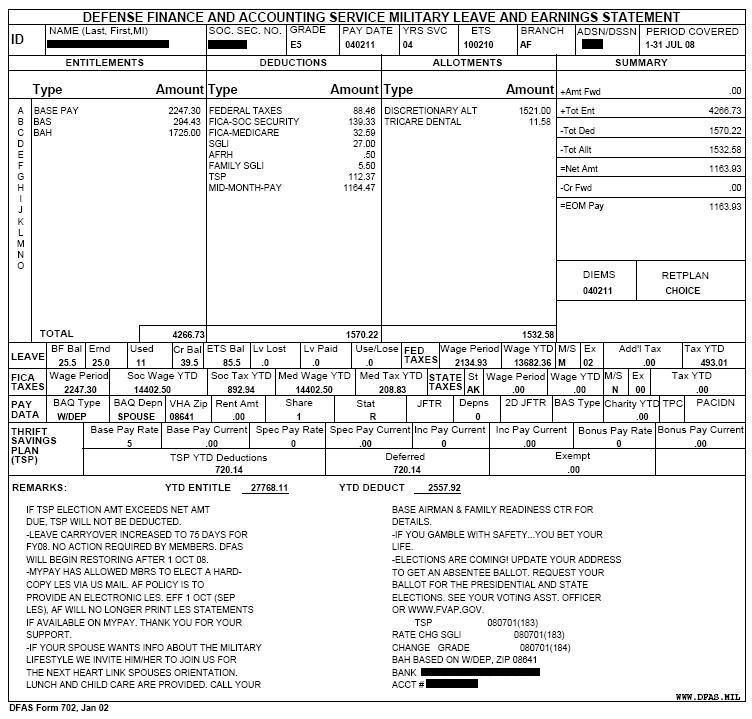

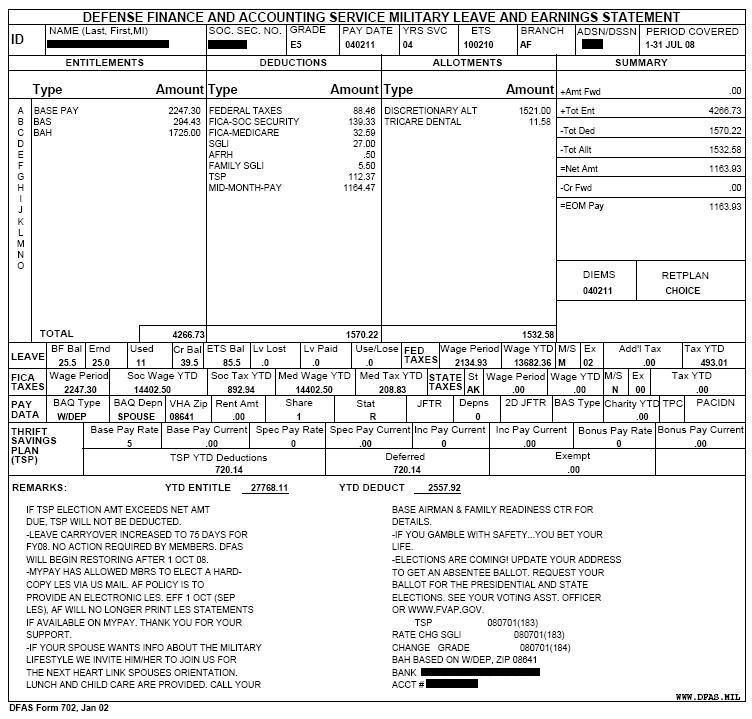

Military Leave and Earnings Statement

Military personnel receive their wages through the LES (Leave and Earnings Statement).

The Entitlements column reflects a military person’s payments and allowances.

The Deductions column shows items that are deducted from the entitlements column including tax withholdings, tax payments, Medicare and debt collections.

The Allotments column shows items paid to a qualified person or business.

There are numerous items that can appear in these three columns for different military personnel in different types of deployment and housing situations. The following lists the most common of these items and how each are counted in the budget when determining eligibility.

Note:

Military pay is received via direct deposit. The name of the bank and account number are listed at the bottom right of the LES.

|

ENTITLEMENTS |

|

|

ENTITLEMENT TYPE |

COUNTS AS INCOME? |

|

SPECIAL PAY

|

YES |

|

BASIC PAY

|

YES |

BONUSES:

|

YES |

|

HOUSING ALLOWANCES:

|

NO |

|

FAMILY ALLOWANCES:

|

NO |

|

MOVING ALLOWANCES:

|

NO |

|

COMBAT PAY |

NO |

|

CLOTHING ALLOWANCE (CMA) |

NO |

|

TRAVEL ALLOWANCES:

|

NO |

|

EDUCATIONAL ALLOWANCES |

NO |

|

DEATH ALLOWANCES |

NO |

|

SUPPORT/COMMUNITY DEBT (CHILD SUPPORT): This is normally child or spousal support owed outside the household and is not extra pay. |

NO |

|

|

||

|

|

|